TCS (Tax Collected at Source) return is a formal report that sellers or service providers are required to file periodically (usually quarterly) to disclose the TCS they have collected on specified transactions as specified under the provisions of Income Tax Act. The TCS Return collected is then deposited with the government by the seller.

The TCS (Tax Collected at Source) return is governed by provision of section 206C of the Income Tax Act, 1961 in India. This provision mandates that sellers of specified goods and services collect tax at source on transactions, with rates varying depending on the nature of the goods, such as alcohol, jewellery and certain minerals. Sellers are required to file TCS returns quarterly using Form 27EQ, detailing the total TCS collected and deposited with the government.

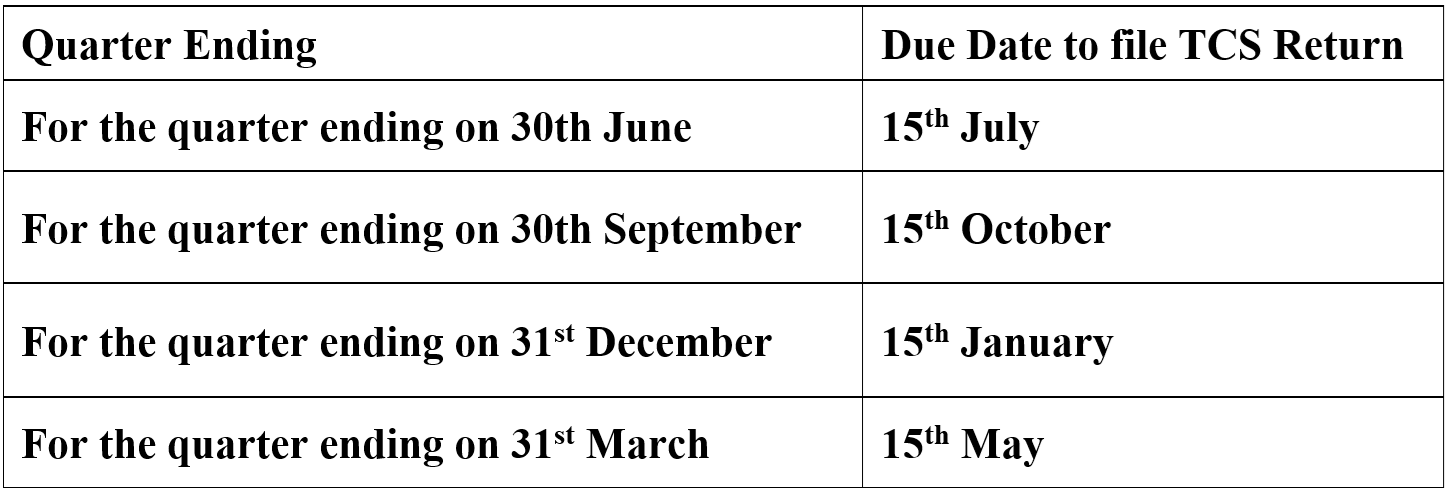

These returns must be submitted by specific due dates, typically the 15th of the month following the end of each quarter. Compliance with these regulations is crucial, as failure to file timely returns or to deposit the collected tax can result in penalties and interest charges. This return includes details such as:

Taxcellent’s CA Services will helps you in guiding about deduction and deposit of TCS along with timely filing of TCS returns.

We have launched a range of Chartered Accountants Services for families along with a complete income tax filing product suite covering ITR-1 to ITR-7. With the launch of our families division, we aim to help millions of Indians with financial literacy, compliance and investment.

Enquiry Now